For the past decade, the Fidelity 500 Index Fund (FXAIX) and Vanguard Total Stock Market ETF (VTI) have been two of the most popular index funds.

Both funds are passively managed, meaning they don’t try to beat the market. Instead, they simply track a benchmark index like the S&P 500 or Dow Jones Industrial Average—their goal is to provide returns that match their respective indexes over time.

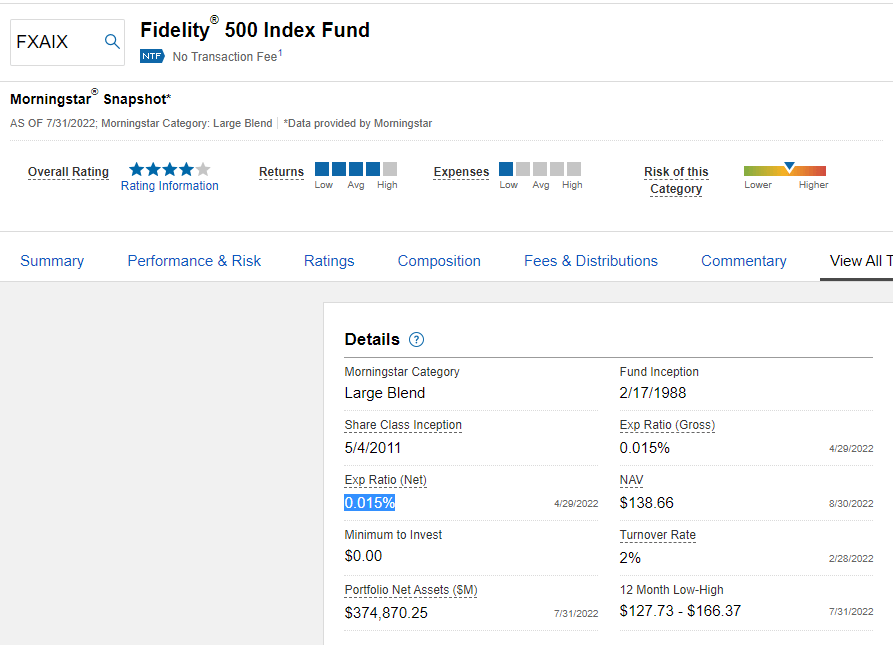

FXAIX: Fidelity® 500 Index Fund

FXAIX invests in 500 large-cap companies in the United States.

The fund offers investors exposure to various industries, including information technology, financial services, industrial goods, healthcare, consumer staples, and energy.

FXAIX charges 0.02% per year. This is one of the cheapest mutual funds (in terms of fees) available in its category.

VTI: Vanguard Total Stock Market Index Fund ETF

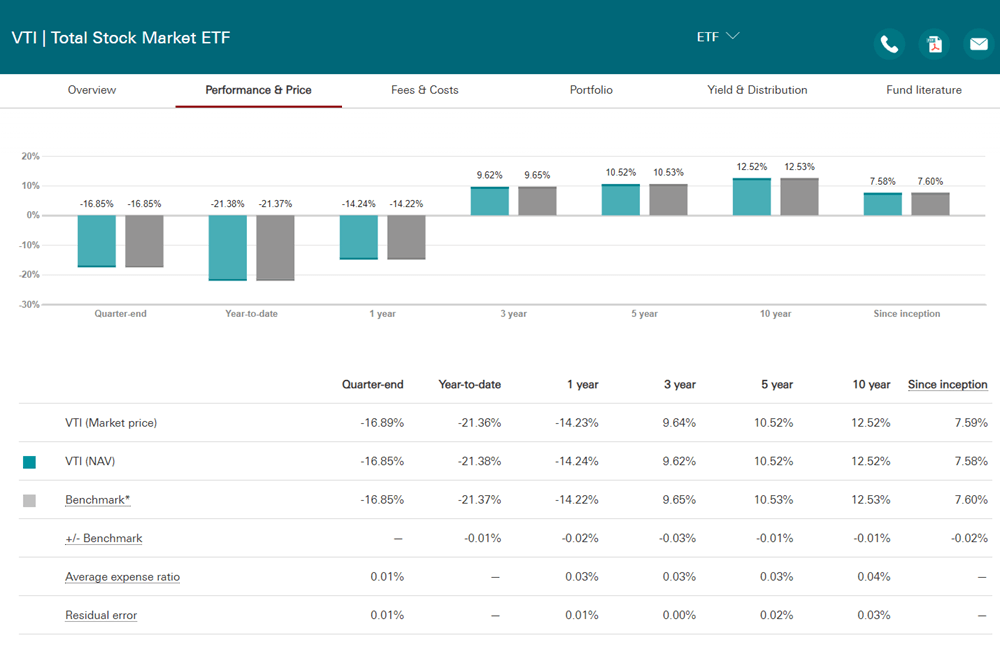

VTI tracks the CRSP U.S. Total Market Index, which contains approximately 4,056 stocks.

Furthermore, the Vanguard Total Stock Market ETF has an expense ratio of 0.04% and $1.2 trillion worth of assets under management.

FXAIX vs. VTI: Key differences

FXAIX is a mutual fund while VTI is an ETF. VTI is tradeable throughout the day, as long as the market is open. A mutual fund like FXAIX can only be bought and sold after the market close. The transaction occurs once a day.

Another difference is cost. FXAIX has a lower expense ratio than VTI, which means you pay less in fees when you invest in this fund.

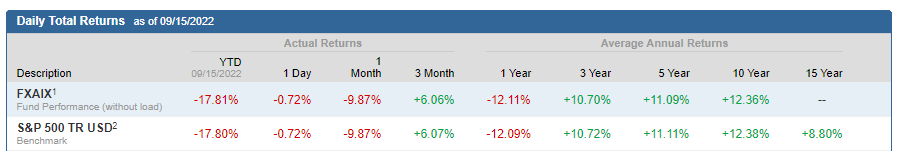

In terms of performance, VTI and FXAIX have similar track records. In the last 5 years, FXAIX has returned 11.81% annually and VTI returned 11.22%.

FXAIX vs. VTI: Which Fund Is Better?

FXAIX and VTI are similar funds. However, investors should be aware that both track different indexes.

The Fidelity fund follows the S&P 500 Index, whereas the Vanguard ETF tracks the CRSP U.S. Total Market Index. Which means FXAIX does not include small- and mid-cap stocks.

If diversification is crucial for you, VTI would be the better fit. Else, FXAIX would be better because it has lower fees and identical annual returns.