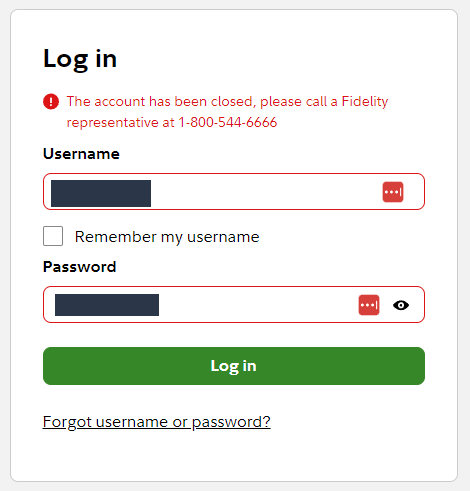

It was on Christmas Eve when I logged in to check my Fidelity account. Back then, I had about $40k invested in FXAIX and $10k invested in SCHD. Little did I know my account had been abruptly closed without notice or warning.

Error: (009981) The account specified in this trade has been closed. As a result, only sell orders for funds and equities are allowed. For other transactions, please call a Fidelity representative at 1-800-544-6666.

If you ever find yourself in a similar situation where your Fidelity account is unexpectedly closed for no reason, here’s what you need to do.

Why Did Fidelity Close My Account?

These are some common reasons for Fidelity account closure.

1. Identity Verification Issues

Sometimes, Fidelity may flag your account for identity verification. This typically happens when there is a discrepancy or inconsistency in the information provided during the account setup process.

2. Incomplete Account Setup

If you haven’t completed all the necessary steps when setting up your Fidelity account, the system may automatically close the account. This could include missing information, incomplete documentation, or unresolved prompts.

3. Fraud Prevention Measures

Fidelity employs stringent security measures to protect account holders from potential fraud. If any suspicious activity is detected within your Fidelity account, it may trigger an account closure until further verification is obtained.

Steps to Resolve Fidelity Account Closure

Step 1: Contact Fidelity Support

Reach out to Fidelity customer support as soon as possible. They are available 24/7 and can provide you with specific details regarding the closure of your account.

Step 2: Be Prepared for Verification

If the closure was due to identity verification, be ready to provide any additional documentation or information they request. This may include a photo ID or proof of residence.

Step 3: Ask for Clarification

During your call with a Fidelity representative, don’t hesitate to ask for a detailed explanation of why your account was shut down. Understanding the specific reason will help prevent a recurrence.

Valuable Insights from the Fidelity Community

Users in the Fidelity community have shared their experiences with account closures.

Some have encountered issues related to identity verification or incomplete account setup. The best way to find out why Fidelity closed your account and resolve the problem is by calling customer support.