Choosing the right robo-advisor can be a game-changer for your investment journey. Today, let’s compare two heavyweights in this arena: Schwab Intelligent Portfolio and Fidelity Go. Each has its strengths, so let’s dive into the details to help you make an informed decision.

Fidelity Go

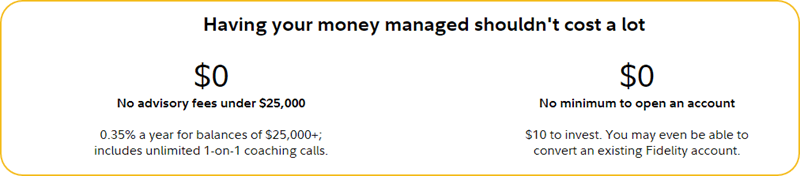

Fidelity Go impresses with its proprietary Flex Funds, offering unique investment choices. For smaller balances, it charges no advisory fees, and the automated rebalancing feature adjusts portfolio allocations based on risk tolerance.

Pros:

- Unique Fidelity Flex Funds.

- No fees for smaller balances.

- Automated rebalancing based on risk preferences.

Cons:

- Fees (0.35%) apply for larger account balances.

- Limited personalized advice, akin to most robo-advisors.

Schwab Intelligent Portfolio

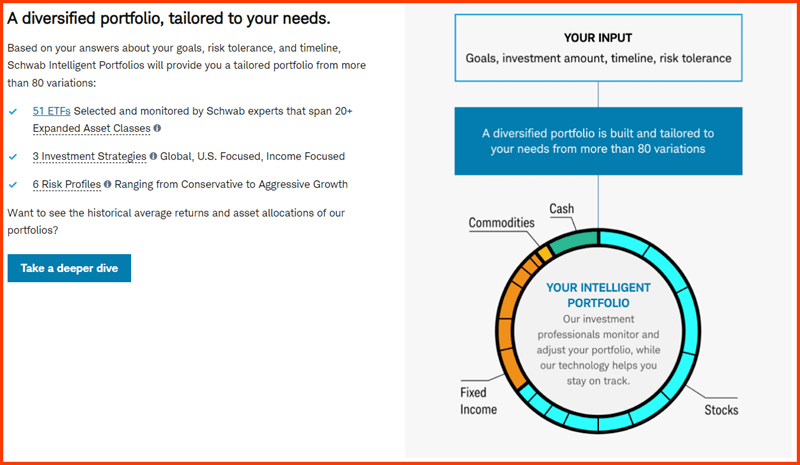

This platform operates on a no-advisory-fee model, making it cost-effective. It utilizes ETFs diversified across asset classes, appealing to those seeking a spread in their portfolio. Moreover, it offers tax-loss harvesting, a nifty feature for minimizing tax liabilities.

Pros:

- No advisory fees.

- Diverse ETF-based portfolios.

- Tax-loss harvesting feature.

Cons:

- Potential operating expenses related to ETFs used.

- Limited personalized advice or human interaction.

Choosing Between Them:

If you prioritize cost-effectiveness and a wide array of ETF options, Schwab Intelligent Portfolio might be your pick. However, be mindful of potential operating expenses tied to the ETFs used.

On the other hand, if you’re drawn to Fidelity’s proprietary Flex Funds and seek a platform with no fees for smaller balances, Fidelity Go could be the better fit.

Happy investing!