FXAIX and SPY are index funds with a long-term investment horizon. The two funds are similar in many ways. Both funds track the same index—the S&P 500—but they also have some differences.

This article will cover the differences and similarities between FXAIX and SPY to help you pick the best investment.

Key Takeaways

FXAIX: Fidelity 500 Index Fund

FXAIX is a mutual fund from Fidelity that tracks the S&P 500 Index. It has a low expense ratio of 0.02%. In addition, FXAIX is classified as a no-load mutual fund, which means it will save investors money upon investing.

FXAIX has had an annualized return of 11.81% over the past 10 years. For context: The S&P 500 Index gained 10.52% annually during this period.

The 10 holdings are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Apple Inc. | AAPL | 7.16% |

| Microsoft Corp. | MSFT | 6.01% |

| Amazon.com Inc. | AMZN | 3.38% |

| Tesla Inc. | TSLA | 2.14% |

| Alphabet Inc. Cl A | GOOGL | 2.00% |

| Alphabet Inc. Cl C | GOOG | 1.84% |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.56% |

| UnitedHealth Group Inc. | UNH | 1.46% |

| Johnson & Johnson | JNJ | 1.32% |

| NVIDIA Corp. | NVDA | 1.30% |

SPY: SPDR S&P 500 ETF

SPY is an ETF that tracks the S&P 500 index. It is intended to be a passive investment, thus it makes no effort to outperform the market and instead aims to match the benchmark.

Unlike FXAIX, SPY is an ETF rather than a mutual fund. Therefore, it trades like a stock and you can buy or sell it throughout the day.

The expense ratio for SPY right now is 0.09%.

FXAIX vs. SPY: Differences & Similarities

As you can see, FXAIX and SPY differ in a few ways. For instance, SPY is an ETF, whereas FXAIX is a mutual fund. In addition, FXAIX has a lower expense ratio than SPY (0.02% vs 0.09%).

Despite these differences in structure and cost, both funds still follow the same benchmark: the S&P 500 Index.

Which is Better? FXAIX or SPY?

So, is FXAIX better than SPY? Well, that’s up to you. If we had to pick one over the other, it would be FXAIX because of its slightly larger net assets and lower expense ratio.

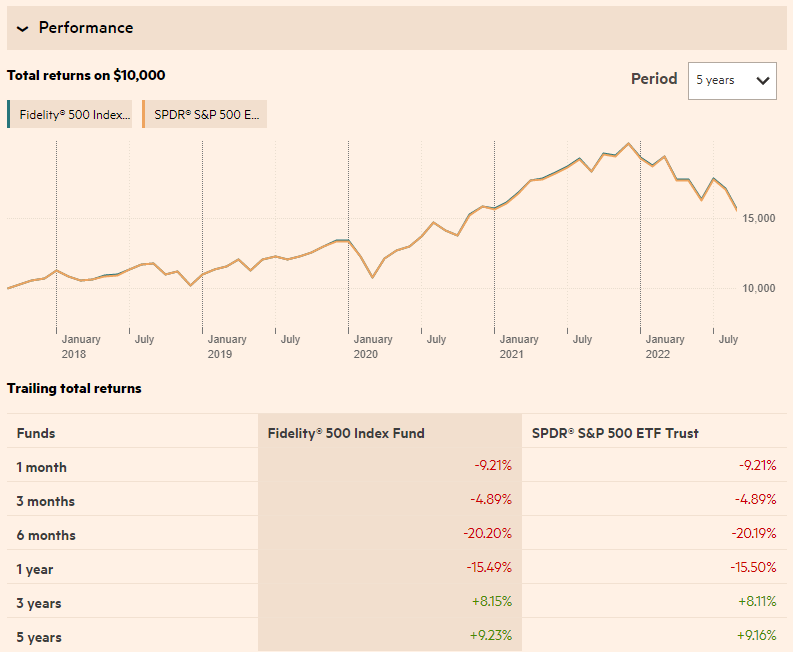

Both funds have comparable asset allocations, distribution schedules, and historical returns.

David J:

While both track the S&P 500 index, FXAIX is a mutual fund and SPY is an ETF.

FXAIX (0.015) is less expensive than SPY (0.09). I like to keep my expenses low. I don’t need the flexibility of selling anytime that an ETF offers. FNILX is similar and has no expenses.

Chris M:

FXAIX will have more capital gains distributions if in a taxable account. If in an IRA then regarding taxes there would no difference. David describe the fee differences. They are like any other ETF regarding fees if you want the benefits of an ETF (trade throughout day, minimums, etc).

Huy N:

SPY is more tax efficient than FXAIX but FXAIX is better for IRA.

In a taxable account, dividends are taxed the year they are distributed. It doesn’t matter what you do with them, they are taxed.

Mutual funds like FXAIX distribute capital gains made from sales made within the fund. ETFs like SPY, being on the exchange, don’t.

Todd A:

As for why you’d rather have ETFs in a taxable account simply comes down to the taxable capitals gains distributions that mutual funds tend to payout. This can generate a rather hefty tax bill and Fidelity funds in particular are notorious for this.

ETFs are able to make “in kind” transfers when they modify holdings within the ETF, eliminating the need to distribute capitals gains and avoiding a taxable event to the investors.

Paul R:

I believe FNILX is also an S&P500 index fund. It has the same holdings, but it just doesn’t use the name S&P500 because it would have to pay a fee and it’s a zero expense ratio fund.

Andrew B:

If you own a Fidelity 500 Index Fund like FXAIX, you won’t be able to sell your shares until the market is closed. That’s one of the many differences between SPY and FXAIX.