How To Fix Plaid Not Linking Bank Account to Fidelity

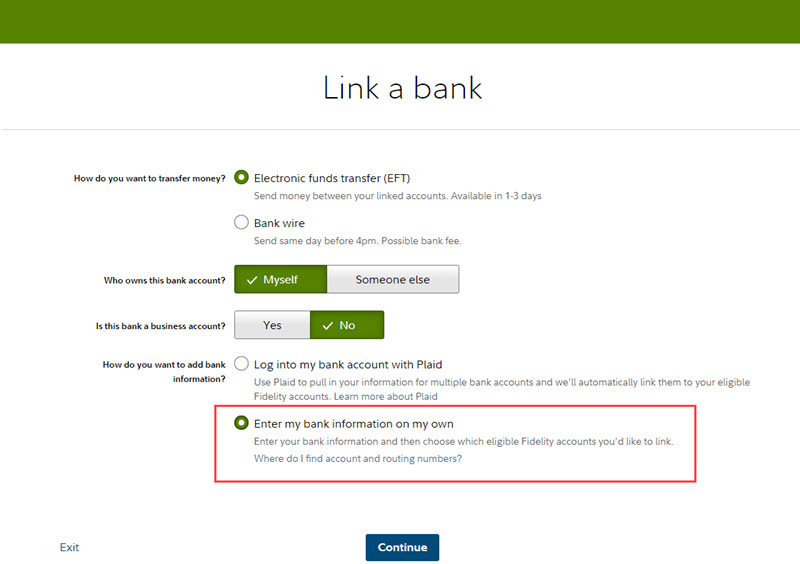

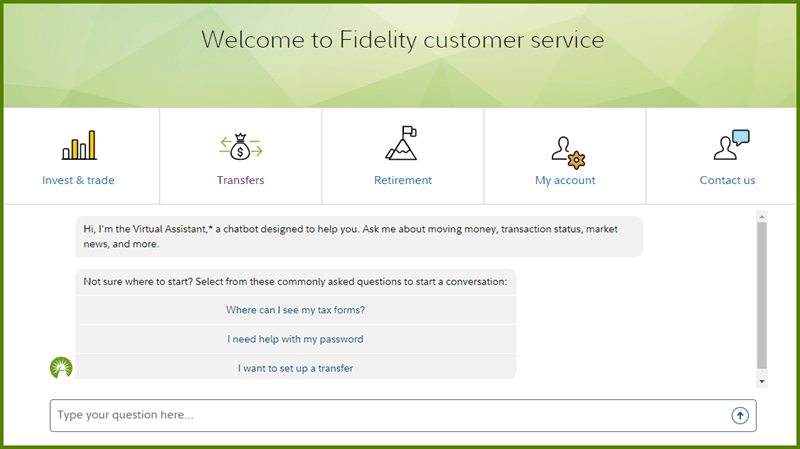

If you’re like me and have been trying to set up a linkage between Fidelity and another institution using Plaid, you might have hit a few roadblocks. From what I gathered, many Fidelity customers also need help with this process. Fortunately, there are alternative methods to get your accounts connected smoothly. Here’s a step-by-step guide … Read more

![[2023 Tutorial] 🚚 How to transfer from Schwab to Fidelity Investments 4 charles schwab to fidelity selection](https://unprompted.xyz/wp-content/uploads/2023/02/charles-schwab-to-fidelity-selection.png)

![[2023 Tutorial] 🚚 How to transfer from M1 Finance to a Fidelity account 5 fidelity start a trasnfer](https://unprompted.xyz/wp-content/uploads/2023/02/fidelity-start-a-trasnfer.png)