As someone who’s been through the process of deciding between a Fidelity Roth IRA and a Fidelity Traditional IRA, I understand how overwhelming it can be.

It’s a decision that will significantly impact your retirement savings.

Here’s my take on the matter:

The Roth vs. Traditional Dilemma

When I started planning for retirement, I heard various opinions on whether to go with a Roth or Traditional IRA. It seemed like everyone had a different perspective, which only added to the confusion.

My Journey with a Roth IRA

After careful consideration, I decided to open a Roth IRA. Why? Well, there were a few key reasons:

Tax-Free Growth: The biggest draw for me was the promise of tax-free growth. I wouldn’t have to pay taxes on my earnings when I withdrew them in retirement was a game-changer.

Flexibility and Accessibility: Another factor that swayed me was the flexibility of a Roth IRA. Unlike a Traditional IRA, I could access my contributions (but not earnings) at any time without penalty. This provided a sense of security, knowing that my hard-earned money was within reach in case of an emergency.

Anticipating Future Tax Rates: I also shared the belief that taxes might be higher in the future. In this context, a Roth IRA seemed like a smart move as it would allow me to lock in today’s tax rates.

The Traditional IRA Consideration

While a Roth IRA was my choice, I understand it’s not a one-size-fits-all solution. There are scenarios where a Traditional IRA might make more sense for you:

High Current Income: If you’re in a high-income bracket now, contributing to a Traditional IRA can provide immediate tax benefits, allowing you to save more.

Expecting Lower Retirement Taxes: If you anticipate being in a lower tax bracket when you retire, the tax deferral of a Traditional IRA might be beneficial.

A Balanced Approach

In the end, I believe in a balanced approach. It’s important to diversify your retirement savings across different “tax buckets.”

This means having a mix of tax-deferred (Traditional), tax-free (Roth), and after-tax (taxable brokerage) accounts. This strategy offers the highest level of flexibility throughout retirement.

Personal Takeaway

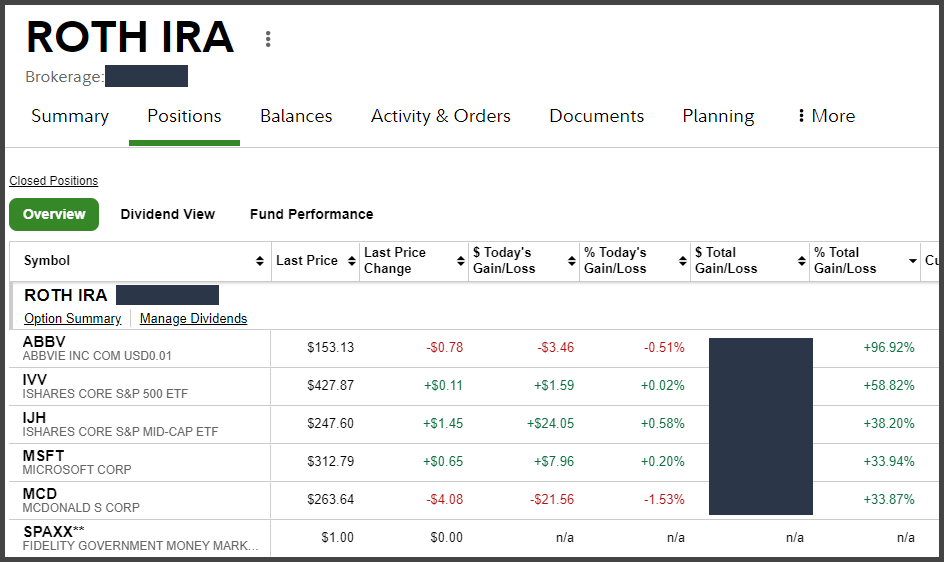

Reflecting on my journey, I’m glad I chose a Roth IRA and opened it with Fidelity. The account growth tax-free over the years has been incredibly satisfying. While I paid higher taxes upfront, it’s proven to be a valuable investment in my financial future.

As for you, the choice between a Roth IRA and a Traditional IRA depends on your circumstances. The key figure you should consider is current income and future expected tax rate.

Best of luck on your journey towards a secure retirement!